Have you got student financial obligation? Listed below are how to get mortgage forgiveness lower than the brand new government statutes

August 2, 2022In the end, for the line (4), we incorporate Part%, Cash?Branch%, Look, Cash?Look, Branch%?Enjoy and cash?Branch%?Look on regression design

August 2, 2022Credit score: A credit rating is actually a mathematical assessment (called an evaluation) of your own creditworthiness away from a borrower

Originally, borrowing partnership membership are simply for people who shared a common thread, together with doing work in a similar community or living in an identical people

It could be allotted to any person, organization otherwise regulators you to definitely would like to borrow funds. Credit assessment and you will research for companies and you will governing bodies could be done by a credit rating agency, including Dun & Bradstreet, Fundamental & Poor’s, Moody’s or Fitch. These types of firms search credit rating, the present monetary standing, the fresh more than likely upcoming money away from a debtor together with capability to pay-off a loan in a timely manner. They assemble, shop, familiarize yourself with, summary and sell such as information, always to your borrower which is seeking to a credit rating having in itself. Fico scores (in addition to sometimes named credit ratings) are used by credit companies as a way of choosing this new creditworthiness away from a debtor getting an alternative loan. For every single financial kits its very own assistance for just what it consider an excellent good credit get, but in standard scores slip over the following the lines:

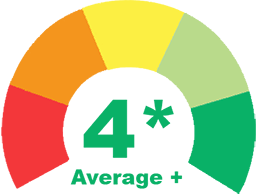

- 300-629: Bad credit

- 630-689: Fair credit (also known as average credit)

- 690-719: Good credit

- 720 or over: Advanced level borrowing

Borrowing Relationship: A cards partnership is a type of financial providers (eg a financial) which is authored, possessed and you will run by the its users. Players pond their cash from the bank in order to be in a position to financing currency to one another. When one deposits money into a card connection membership, they will get a partial manager, and this person reaches express in the borrowing union’s winnings.Payouts may also be employed to financing systems and you will services you to definitely may benefit the community in addition to interests of the people. In such a case, the goal is to best town, to not make a profit, and thus borrowing unions are thought maybe not-for-funds teams. Borrowing commitment professionals have a ballot in the electing their board out of directors. Borrowing from the bank unions offer of numerous banking services, eg consumer and you will industrial funds (usually during the all the way down interest rates than simply old-fashioned finance companies), mortgage loans, offers levels (constantly at the highest interest rates), playing cards or any other financial features. Borrowing from the bank unions assortment in proportions away from short, volunteer surgery to help you higher businesses having lots and lots of people. They’re molded by high agencies as the a benefit to have their staff. In the recent past, credit unions has loosened its restrictions into membership, which dismayed old-fashioned finance companies, who possess to pay business income tax on their winnings. Borrowing unions, while the low-earnings communities, needn’t pay one to taxation. And additionally look for Board out of Directors, Desire, Financing, Financial, Cash.

Plus find Resource, Loan

Creditor: A creditor try a man, company (such as a company otherwise providers) to help you just who money is due. A creditor offers borrowing by the loaning currency that is likely to become reduced later. A business that give goods and services to some other organization or private and won’t request commission quickly also is considered an excellent collector. Financial institutions are classified since both individual or genuine. People who financing money in order to household members or family are private loan providers. Genuine creditors, eg finance companies or boat loan companies, has actually court contracts towards borrower, hence possibly grants the creditor the authority to claim or grab the borrower’s assets (particularly, a vehicle) if he or she doesn’t pay-off the borrowed funds. Creditors benefit of the charging you attention to the loans they give their clients.

Currency: Money is actually an usually approved variety of currency, and additionally gold coins and you can papers notes, which is awarded from the an authorities and you may circulated contained in this a society. It’s made use of just like the a method off exchange for items and you may properties.The real history out of money in the The united states began which have furs to own change. Gold-and-silver nuggets and gold-dust then followed, nonetheless turned into too heavy and you may difficult to take irrespective of where they are needed. So certain governments began giving their unique papers bills and you may gold coins one to represented various other given philosophy redeemable in the silver otherwise silver. Following the Civil War, the fresh states was indeed joined below you to federal government, and another brand of paper currency (brand new dollars) are granted about land. Nonetheless, the fresh new papers dollar try redeemable to possess an equal value number of silver. People had depend on about worth of the brand new dollars, as they understood they could get it getting gold when they selected. Inside 1971, President Nixon revealed that You.S  . dollars carry out no longer end up being linked with the newest gold standard, thus a man cannot receive his or her dollar to have an equal number within the silver. Which meant the money would be worthy of a dollar, because everyone in the nation experienced or got depend on that it would be. Today, in addition to material coins and you may papers expense, progressive U.S. currency also contains inspections removed away from bank account, money sales, travelers’ monitors and electronic transfers or electronic bucks, such as BitCoins. The brand new currency of your All of us has come a long method off exchange furs so you can electronic signals off a pc.

. dollars carry out no longer end up being linked with the newest gold standard, thus a man cannot receive his or her dollar to have an equal number within the silver. Which meant the money would be worthy of a dollar, because everyone in the nation experienced or got depend on that it would be. Today, in addition to material coins and you may papers expense, progressive U.S. currency also contains inspections removed away from bank account, money sales, travelers’ monitors and electronic transfers or electronic bucks, such as BitCoins. The brand new currency of your All of us has come a long method off exchange furs so you can electronic signals off a pc.